Avoid the paperwork whiplash: PAN/TIN basics for non-resident founders and finance teams expanding into India

Streamline India expansion by mastering PAN/TIN basics. Learn how to navigate Indian tax IDs, compliance, and registration for non-resident founders and finance teams.

ByNilesh@kaam.work / October 3, 2025 / 12 min read

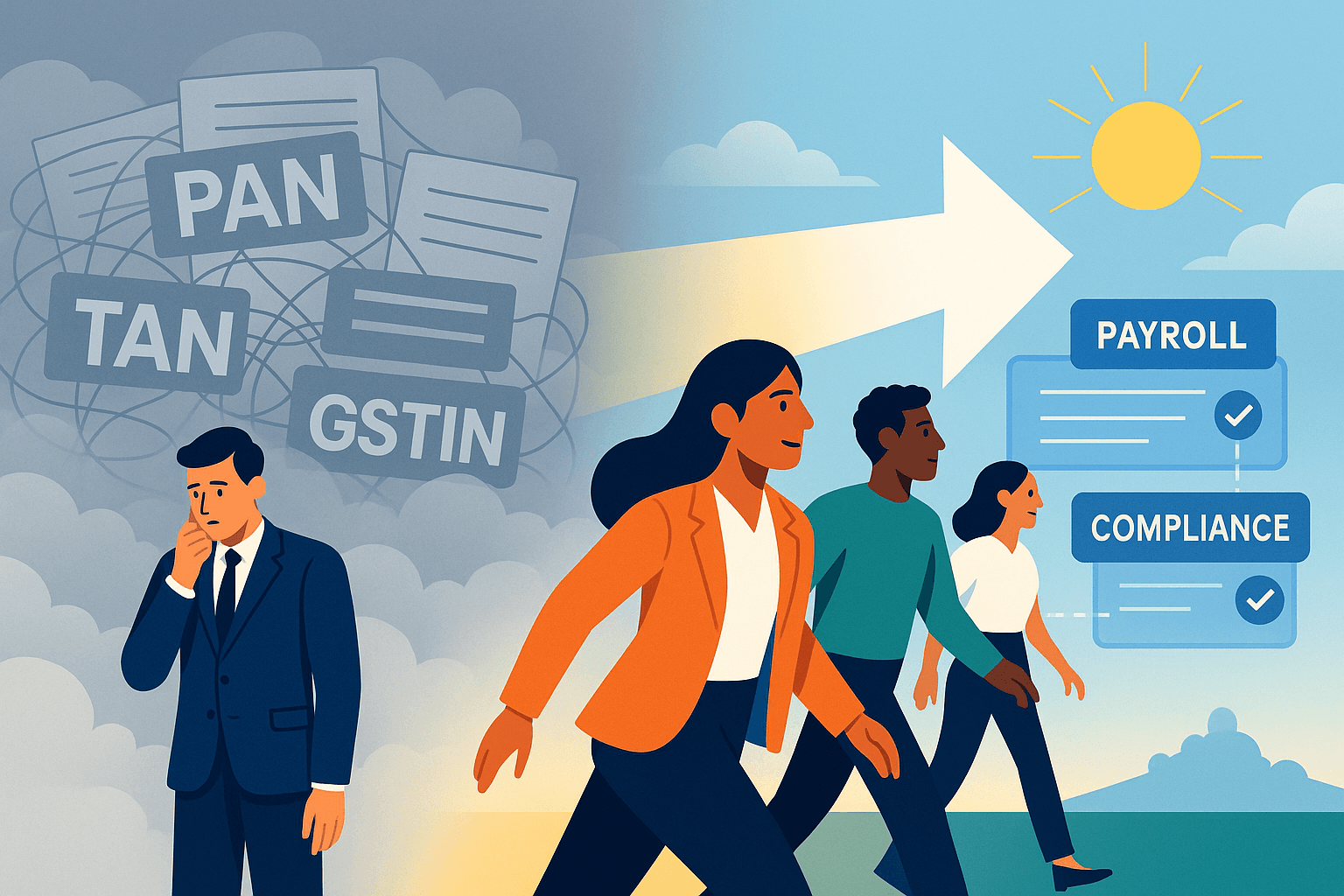

Your finance team just asked about getting a foreign tax identification number India. Now you’re staring at a wall of acronyms that make the tax code look simple.

Setting up a business in India involves paperwork (a hell lot of). And that, unfortunately, often slows India’s expansion more than hiring does.

Finally, when you reach the hiring stage, you’re hit with an acronym avalanche. PAN, TAN, GSTIN, DIN, DSC, FRRO, bank KYC, and what not. Each looks urgent, comes with its own forms and government portals that look like they haven’t been updated since 2003.

But the hard part isn’t filling out forms. It’s knowing what’s truly mandatory on Day 1, what can wait 30 to 90 days, and what you don’t need at all yet.

This guide cuts through the confusion. We’ll take you through the basics of PAN vs TIN and other foreign tax identification number India. This will help you save time and prevent costly mistakes.

Ready to skip the paperwork paralysis and focus on what actually moves your India expansion forward? Read on!

Start with the plan, not the forms

The biggest mistake most US companies make is wasting time. You spend months researching tax IDs and entity structures before even deciding how you actually want to operate there. By this time, your competitors are already interviewing candidates and building teams.

But the smart ones flip this approach. They start with their hiring timeline and growth plans, then choose the legal structure that matches their needs. Now there are two paths to launch your business in the foreign land of India. Let’s get to know them.

Two paths to launch: hire-now (EOR-first) vs entity-first

Path #1 EOR approach:

- Goal: Start interviews and onboarding within weeks without opening a local entity

- Speed: 2-3 weeks to first hire

- Control: You own hiring, performance, culture; EOR handles payroll and compliance

- Cost: Flat monthly fee per employee (typically $500-600/month)

- Best for: Companies wanting to test the Indian talent market or scale quickly

Path #2 Entity-first approach:

- Goal: Create a permanent India footprint with full in-country operations

- Speed: 4-6 months minimum for entity setup

- Control: Complete operational control but significant setup complexity

- Cost: $50K-100K+ setup costs, ongoing legal/accounting overhead

- Best for: Companies committing to long-term, large-scale India operations (20+ employees)

What each path unlocks for hiring, payroll, and payments

Now let’s compare EOR with a legal owned entity to give you more clarity:

With an Employer of Record, you get just enough infrastructure to hire quickly and stay compliant without drowning in setup. That means:

- Compliant local employment without needing your own entity.

- Payroll and benefits administration handled end-to-end.

- Basic HR policies aligned with Indian labor law.

- The ability to test the market before committing to a long-term footprint.

Setting up your own entity gives you the keys to operate like a full local business. That unlocks:

- Direct client billing in India (and GST registration).

- Office leases under your company’s name.

- In-house payroll and HR systems tailored to your processes.

- Vendor contracts and bank accounts to run operations independently.

What’s the trade-off: With EOR-first, you delegate compliance to a specialized operator while maintaining hiring control.

With entity-first, you control everything directly but assume full regulatory responsibility. From payroll and admin work to hiring and managing the business, every single thing. And you actually end up spending 10-20% of employee costs even before hiring. Besides cost, you handle distraction.

Your leadership team ends up spending time on HR policies and compliance minutiae instead of building products and scaling teams. Smart US firms like Tripadvisor and Ideal Image chose to start with our Kaamwork EOR model and saved 80% on overheads.

What PAN is and how entity PAN differs from individual PAN

Now, coming to what a PAN card is. Well, a PAN (Permanent Account Number) is essentially India’s version of a Social Security Number, but for tax purposes. Every individual and business entity in India receives one, and it accompanies them throughout all their financial transactions. For US citizens/firms, it is a foreign tax identification number India.

An entity PAN is tied to the Indian company. It is the base ID used for income tax filing, banking KYC, and many registrations. Meanwhile, an individual PAN is issued to normal citizens like you and me. So, if you hire a director or authorized signatories in India, you need their PAN.

Format of PAN: Ten characters arranged as AAAAA9999A (like ABCDE1234F)

- First three letters: indicate type of Entity (AAA for individuals, companies get different codes)

- Next two letters: it’s either your name or business name

- Next four digits: Sequential numbers

- Last letter: Check digit for verification

Purpose: PAN helps the Indian tax department track all your financial transactions. It is like your financial fingerprint; every big money move is tied to it.

Issued by: Income Tax Department through authorized agencies like NSDL and UTIITSL.

To get a PAN card, you need to submit Form 49A (for individuals) or Form 49AA (for foreign nationals) along with identity proof, address proof, and date of birth proof. You can apply online or visit authorized centers.

When PAN is required & when it is not required

Absolutely required for:

- Opening an Indian bank account

- Issuing invoices to Indian customers

- Filing income tax returns

- Direct payroll processing under your own entity

- Most commercial lease agreements

- Large vendor contracts (typically over ₹50,000)

Not required on Day 1 if:

- You’re using EOR services for employment

- No immediate plans for local invoicing

- Not opening bank accounts initially

- Operating purely through service agreements

“TIN” in India: what people really mean

India uses several tax IDs. That can be confusing for foreign teams. A TIN, or Taxpayer Identification Number, still matters for many businesses. It is an 11-digit identifier issued by state tax authorities. Just like PAN, TIN applications can be made online and offline both.

TAN for withholding tax (TDS)

The moment you start thinking about payroll in India, you’ll need a TAN (Tax Deduction and Collection Account Number).

TAN is a 10-character alphanumeric code that looks like ABCD12345E. The motto is to deduct and deposit tax at source on salaries and vendor payments. P.S. It’s mandatory for all employers to collect and file TDS with the government.

When you need TAN: The moment you start paying employees or certain vendors directly from your Indian entity. If you’re using an EOR, they handle TDS compliance under their TAN.

Format: Ten characters arranged as AAAA99999A

- First 4 letters: Usually based on your company name

- Next 5 digits: Sequential numbers

- Last letter: Check digit for verification

GSTIN for indirect tax

To simplify the old indirect tax structure, India introduced GST reforms in 2017. Every business that collects GST gets a GSTIN — a 15-digit number unique to each taxpayer. The motto of GSTIN is to collect and remit goods and services tax on taxable supplies.

Basic format (what each part means):

- First 2 digits: state code.

- Next 10 characters: the entity’s PAN.

- 13th digit: entity number (if multiple registrations under the same PAN in a state).

- 14th character: usually ‘Z’.

- 15th: checksum character.

When you need a GST: when selling taxable goods or services in different states and UTs of India, or when crossing income thresholds.

Practical note: if you expect to issue Indian invoices or claim input tax credit, register early. Registration is done on the GST portal, and verification can take a few days to weeks, depending on the case and documents.

In short, each tax function has its own identifier. TL;DR - PAN for income tax, TAN for withholding tax, GSTIN for goods and services tax.

What to do by Day 0, Day 30, Day 90

Must-do items on a simple timeline

We saw the tax regimes and paperwork. That’s fine. But many foreign companies wonder: what do we need on day one? Here is a simple timeline.

Day 0–7 (decision & prep):

- First, decide - want to be EOR-first or entity-first.

- Finish the headcount and role map.

- Get important papers like passports, business paperwork, and proof of address, together.

- Map ERP/payroll fields now so invoices and payslips match future registrations.

Day 30 (entity-first focus):

- Apply for a business PAN (if you think about setting up an Indian company or branch).

- Apply for TAN if you will run payroll or make TDSable payments.

- Initiate bank KYC and establish communication channels with the bank for corporate accounts.

- Draft invoice templates (PAN/GSTIN/TAN placeholders) so finance and sales teams can use them when registrations arrive.

Day 90 (scale & indirect tax):

- Apply for GSTIN if turnover or activity requires it.

- Finalize leases and local registrations (shops and establishments, professional tax, state labour registrations), depending on the state.

- Finish banking and payment rails.

What can wait without blocking hiring?

We just gave you the timeline. As you can see, with entity-first, you have to handle all registrations: PAN, TAN, GSTIN, bank KYC, leases, and state labour registrations. It is a heavier upfront load.

But with EOR, you can skip the paperwork drama for the first 90 days. (Yes, you heard that right!). No need for entity PAN/TAN/GSTIN, bank account, or leases. With an EOR like Kaamwork, we cover payroll, hiring, TDS, compliance and every registration work. We help you save 3–6 months of setup, 10–20% in overhead costs, and extra headcount for HR and finance professionals.

Still, maintain a simple parking list with triggers like “revenue > X”, “local invoices > Y”, or “lease signed” so you know when to move registrations.

Do you need a PAN now? A quick decision guide

Ask three clear questions:

- Will you issue Indian invoices or collect GST in the next 90 days?

- Will you pay salaries or vendors directly from an Indian entity bank account?

- Do you need a lease or property in the entity’s name now?

- Are you looking to file corporate taxes?

If the answer is yes to any of the above, apply for PAN.

And if you answered “no” to all of these, congratulations – you don’t need PAN yet. You need to start hiring.

If you choose the EOR model, you can skip all of these until you move into entity-first. But, if you outsource work and have to issue invoices or sign contracts with freelancers under your own Indian entity, PAN becomes the first mandatory step.

Typical scenarios for non-resident companies

- Pilot team via EOR: want to check the environment before going full-scale? Then no PAN is required.

- Services billing to Indian customers: Planning to sell services to Indian companies? Now we’re talking PAN territory, plus TAN for tax deductions, possibly GSTIN for goods and services tax.

- R&D center with no local revenue: Building a development team with no local revenue? PAN and TAN only when you run payroll yourself.

Hire now, file later: the EOR-first option

Look, here’s what happens on Day One with a solid EOR setup like Kaamwork:

Your new hires get onboarded in less than 30 seconds, they get employment contracts, and access to all benefits. They upload their ID proofs and verify themselves on our platform. They follow local policies for leave and holidays. They get paid in INR on time, every time.

Meanwhile, you focus on what actually matters: building your team and growing your business. All the technical stuff, like managing payroll, taxes, and legal compliance is handled by us.

Guardrails to stay compliant while you scale

Speaking of compliance, it’s essential to have a framework. It can help avoid future headaches while you hire.

Get the Employment Structure Right

Your India hires need proper employee status, not contractor workarounds that’ll bite you later. Always maintain clean IP assignments and confidentiality agreements, like an NDA, in place.

Immigration Reality Check

Skip the visa complexity unless someone genuinely needs to relocate. Remote-first means your Head of Engineering in Bangalore never needs a US visa to own global products.

Mirror Your HQ Security Standards

Your new Bangalore developer gets the same data, setup process, training, and protocols playbook as someone joining your San Francisco office. The only difference? They’re probably getting better coffee.

Using Kaamwork’s EOR layer, you get a team that feels like a natural extension of your US operations and not a separate project.

If you choose entity-first: a clean filing sequence

Now, some companies need complete control from day one. Fair enough. Here’s the sequence that won’t make you want to throw your laptop:

- Step 1: Get incorporated and grab those digital signatures (DSC)

- Step 2: Apply for PAN, then TAN immediately after.

- Step 3: Open bank accounts (good luck with the KYC). P.S. This step breaks most companies, so expect a minimum of 4-6 weeks.

- Step 4: GSTIN if you’re actually selling stuff. Skip this if you’re purely building an R&D center here.

State registrations and the document pack

The EOR model was simple. But Entity-first means you’re in the thick of it. Each state has its own requirements, but you’ll typically need:

- Shops and Establishment license

- Professional Tax registration

- Labor law registrations (where applicable)

- Passport copies

- Proof of address for business

- Board resolutions authorizing operations

- Power of attorney documents

All the documents need proper notarization. One misplacement and you’ll be weeks behind in your Indian business approval. So, if your incorporation shows “123 Main Street” but your bank application says “123 Main St,” expect rejection letters and restart delays.

Directors and signatories outside India

DIN, DSC, and identity hygiene

- Director Identification Numbers (DIN): Required for all directors of Indian companies.

- Digital Signature Certificates (DSC): Mandatory for electronic filing of documents. Directors need Class 2 or Class 3 certificates, depending on their role.

Both can be secured remotely, but the process involves multiple government portals and precise document formatting.

When foreign directors need a PAN

- Most Indian banks require individual PAN cards for foreign directors opening company accounts.

- Directors signing lease agreements, major vendor contracts, or certain regulatory filings need individual PANs beyond the company PAN.

Withholding tax made simple

Entity-first means handling Tax Deducted at Source (TDS) by yourself. And taxes are complicated in India.

Firstly, you have to figure out who’s taxable and at what slab. Then, you’re dealing with tax rules and deadlines on government portals that feel built for accountants, not business leaders. Even something as basic as deducting and remitting TDS can eat up weeks of your finance team’s time.

Kaamwork’s tech EOR platform takes that off your plate. We handle:

- Monthly payroll runs, adjusted for leave and benefits.

- Correct TDS calculation and deposit, without your team touching government systems.

- Compliance filings, so you never miss a deadline.

When TAN is mandatory, and what happens without PAN

Here’s where most non-resident founders get tripped up. Salary and vendor payments in India aren’t just “pay and forget.” They trigger TAN and TDS deposits.

And if you try to run payroll without a PAN? Expect higher withholding, extra paperwork, and plenty of compliance friction. Check the documents below.

Evidence that your bank and auditors will ask for

Banks and auditors don’t run on trust. They’ll ask for TDS challans, Form 16/16A, vendor declarations, invoice trails — basically, the receipts for every rupee moved.

Put IDs neatly into your ERP

Mismatch one field in your ERP, and payments can stall. PAN, TAN, GSTIN, legal name, registered address — they all need to be captured cleanly, or you redo the work later.

Kaamwork’s platform builds these IDs into your payroll and finance processes from day one.

Month-end close becomes way less dramatic when your ERP is already audit-ready. Meanwhile, you hire staff without tripping over missing IDs.

From EOR to your own entity without rework

So, you start with the EOR model, and now you have 25+ employees and want full operational control. So, how does one transition from EOR to a full-blown entity?

When to trigger PAN, TAN, and GSTIN as you scale

- When headcount makes sense. At 20-25 employees, EOR fees often match the cost of running your own HR and payroll infrastructure. Use our global employee cost calculator to find out for yourself.

- Local billing becomes essential. Need to invoice Indian customers directly? Want GST registration for better business relationships? These require your own entity.

- You have real estate plans. If you’re planning to set up a hybrid office in India, then you will need to have PAN, GST and other documents in hand.

Still confused? Here is a decision gate checklist for leaders. If you answer “yes” to two or more, it’s time to consider entity setup.

- Are we spending over $10,000 monthly on EOR fees?

- Do we plan to bill Indian customers in the next 6 months?

- Are we looking for office space or significant local vendors?

- Would having an Indian entity help with our tax strategy?

- Do we need better control over payroll timing and processes?

- Are we planning to hire 10+ more people in India this year?

Novation and payroll migration

Start with critical suppliers, then move to administrative vendors. Your team signs new employment contracts, but this time with your entity. No termination and rehiring drama. Most employees prefer this option because it offers the same job with more stability.

Handy tools for founders and finance

One-page PAN, TAN, GSTIN checklist

| ID Type | Purpose | When you need it | Processing Time |

|---|---|---|---|

| PAN | Income tax identification | Banking, invoicing, tax filing | 7-14 days |

| TAN | Withholding tax from salaries | Direct payroll processing | 7-10 days after PAN |

| GSTIN | Sales tax collection | Revenue >₹20 lakhs or B2B invoicing | 15-30 days |

| DIN | Director identification | All company directors | 10-15 days |

| DSC | Electronic signatures | Filing returns and documents | 7-10 days after DIN |

KYC packet index and naming conventions

Here’s a file structure that banks and auditors actually like.

Folder 1: Company Documents

- Certificate of incorporation (certified copy)

- Memorandum and Articles of Association

- PAN card copy

- Board resolution for bank account opening

Folder 2: Director Documents

- Passport copies (notarized)

- Address proof for each director

- Photographs as per bank specifications

- Individual PAN cards where required

Folder 3: Address Verification

- Registered office lease agreement

- Utility bills (electricity, internet, phone)

- Property ownership documents or NOC from the landlord

Gantt timeline for filings, banking, and payroll go-live

Weeks 1-4: Incorporation and DSC applications (parallel processing)

Weeks 5-6: PAN application immediately after incorporation approval

Weeks 7-8: TAN application, banking KYC preparation

Weeks 9-12: Bank account opening (longest step, often delayed)

Weeks 13-14: GSTIN if needed, payroll system setup and testing

Weeks 15-16: Employee novation, first payroll run under new entity

Where Kaamwork fits in your PAN/TAN timeline (EOR-first)

Here’s how Kaamwork smooths the path:

- Day-one employer layer → contracts, payroll, PF/ESI, benefits, and local HR policies sorted.

- You keep 100% control → you source, interview, and decide; Kaamwork runs compliant HR ops.

- Sequence paperwork → hire immediately; push PAN/TAN/GSTIN filings to when they matter.

- Finance clarity → INR salary bands you set + one flat employment-ops fee of $599 per employee per month.

- Build-to-own → when you’re ready, Kaamwork novates employees and migrates payroll cleanly.

What to do next

The paperwork will always be there. The best candidates won’t. If you wait for PAN, TAN, and GSTIN before hiring, you risk losing talent to competitors who moved faster. So, choose your path, assign owners and start hiring. We have helped companies like TripAdvisor, SimpliSafe, and Thrasio scale India teams with A+ talent and still save 80% overhead. What are you waiting for? Talk to Kaamwork today.